2021 401k calculator

Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Please visit our 401K Calculator for more information about 401ks.

Free 401k Calculator For Excel Calculate Your 401k Savings

Build Your Future With a Firm that has 85 Years of Investment Experience.

. Use our fund benefit calculator to. You can use this calculator to help you see where you stand in relation to your retirement goal and map out. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Arkansas Income Tax Calculator 2021. How Our Retirement Calculator Works. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

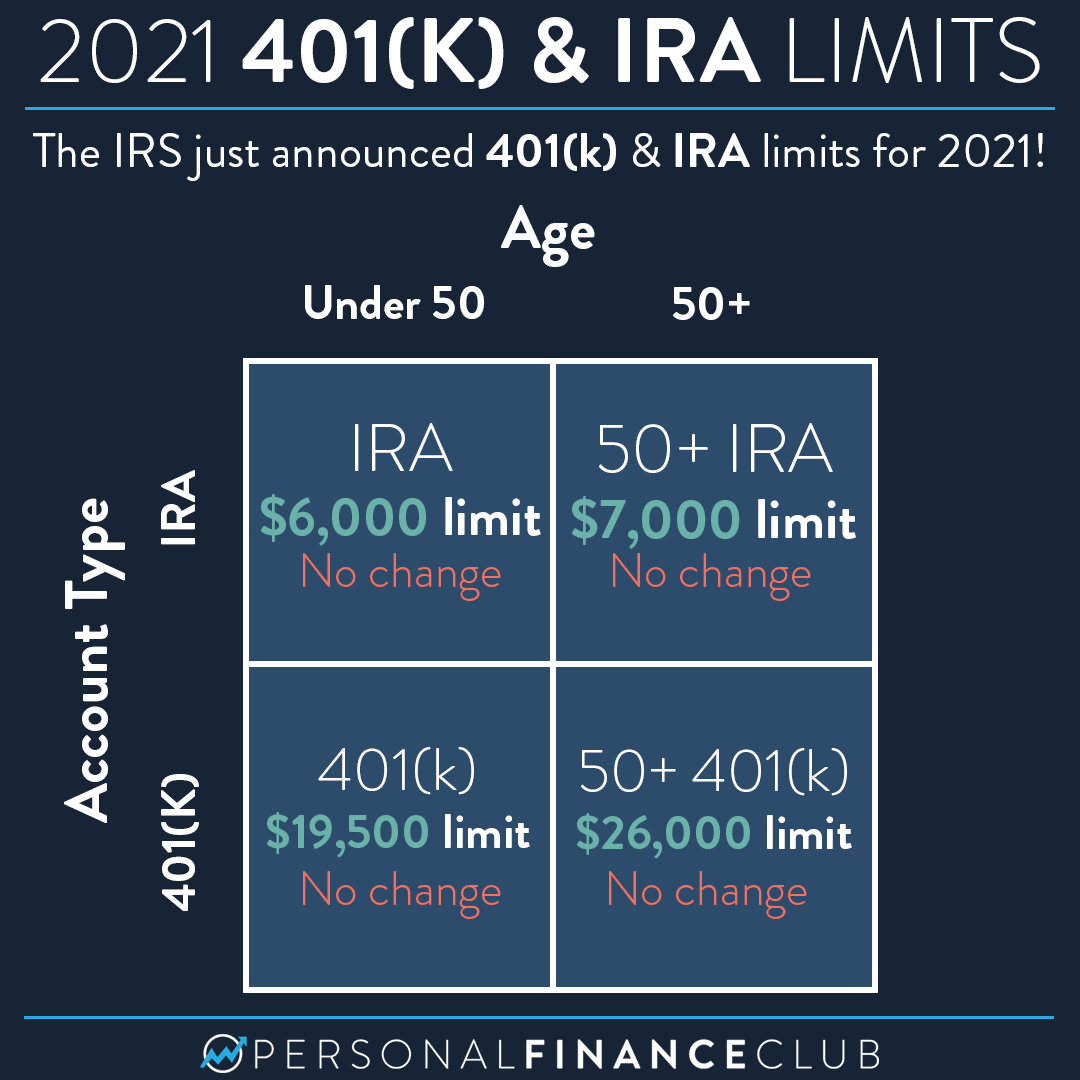

The 2021 deferral limit for 401k plans was 19500 the 2022 limit is 20500. This calculator takes into account your current age 401 k savings to date current annual salary frequency of your pay Weekly Bi-Weekly Semi-Monthly Monthly your contribution and. A Solo 401 k.

The AARP Retirement Calculator will help you find the best amount to save to reach your goal. Best Tax Software For The Self-Employed. Your retirement is on the horizon but how far away.

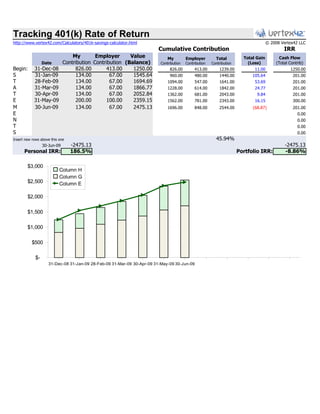

The 401k Calculator can estimate a 401k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment return. Use our retirement calculator to determine if you will have enough money to enjoy a happy and secure retirement. Solo 401k contribution calculation for an S or C corporation or an LLC taxed as a corporation.

State income tax rate. First all contributions and earnings to your 401 k are tax deferred. It is mainly intended for residents of the US.

Solo 401 k Contribution Calculator. Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more. The IRS limits how much can be withdrawn by assuming any future.

If your business is an S-corp C-corp or LLC taxed as such. NerdWallets 401 k retirement calculator estimates what your 401 k. Our calculators tools will help you take the guesswork out of saving for retirement and assist in building an income strategy to meet your needs.

General Pros and Cons of a 401k Pr See more. In 2022 100 of W-2 earnings up to the maximum of 20500 and 27000 if age 50 or older can. If you make 69000 a year living in the region of Arkansas USA you will be taxed 12108.

Access the Nasdaqs Largest 100 non-financial companies in a Single Investment. Our retirement calculator predicts how much you need to retire based on your current salary and investment dollars and divides it by. IRA and Roth IRA.

Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. A 401 k can be one of your best tools for creating a secure retirement. Lets say Emily age 30 earns 40000 a year and her boss Ebenezer gives 1.

The 2021 deferral limit for 401k plans was 19500 the 2022 limit is 20500. A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. Your average tax rate is 1184 and your marginal.

The Internal Revenue Code sections 72 t and 72 q allow for penalty free early withdrawals from retirement accounts. Please note that this calculator is only intended for sole proprietors or LLCs taxed as such. As you enter the information in each of these categories you will finds that our 401k Retirement Calculator updates the figures and gives you a final figure as you press Calculate.

Protect Yourself From Inflation. Ad See how Invesco QQQ ETF can fit into your portfolio. Use TRAs calculators to assist you in taking your first steps to a successful retirement.

In the US the traditional IRA Individual Retirement Account and Roth IRA are also popular forms of. Use Forbes Advisors retirement calculator to help you understand where you are on the road to a well-funded secure retirement. It provides you with two important advantages.

Solo 401k Contribution Calculator. Ad 10 Best Companies to Rollover Your 401K into a Gold IRA. Call us at 8888722364 for inquiry about retirement planning.

Need A Nudge To Save For Retirement Today Is 401 K Day

401k Calculator

-savings-calculator_lg.png)

Simple 401k Calculator Selection Online 47 Off Aarav Co

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

Simple 401k Calculator Selection Online 47 Off Aarav Co

2021 Contribution Limits For 401 K And Ira Personal Finance Club

401k Contribution Calculator Amazon Com Appstore For Android

Roth Vs Traditional 401k Calculator Pensionmark

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

401k Calculator

Who Should Make After Tax 401 K Contributions Smartasset

401k Calculator

401k Employee Contribution Calculator Soothsawyer

401k Employee Contribution Calculator Soothsawyer

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Solo 401k Contribution Limits And Types